Have you heard your friend talking about financial wellness? Well, you should know that it is the

capacity to plan for the future and have a sound financial life. From entailing sensibly managing

your earnings, savings, debt and investment to others - everything comes under it. As a result of

this, stress can be decreased while physical and mental health can be enhanced.

Financial wellness also can improve the quality of life. Even though it is influenced by a range of

factors, by setting up a budget for essential spending, you will be able to do better money

handling and enhance your financial well-being. To find out how managing your expenses

can improve your overall well-being and tips to reduce financial stress, read further.

How Managing Your Expenses Can Improve Your Overall Well-Being?

When you manage and track daily expenses, you can improve your overall well-being

in several ways. Some of these ways include the following

1. Support Mental and Physical Health

When you follow an expense management solution to track finances and stay on top

of expenses, it can reduce feelings of worry. As a result of this, your mental well-being is

protected. Also, it can reduce financial stress as it can lead to improved sleep, exercise, and

nutrition habits. This further helps to support the physical well-being of an individual.

2. Increase Financial Security

You can have a clear picture of your finances and make intentional decisions. Such spending can

lead to a sense of stability and peace of mind. As a result of this, financial security can also

be increased.

3. Allow for Goal Achievement

When the expenses are prioritized using financial management apps and saving for

specific goals, you can make progress toward what is important to you. It can help to boost

motivation and self-confidence.

4. Improve Relationships

When you manage expenses, it can reduce conflicts with partners or family members regarding money.

As a result of this, the promotion of healthier relationships can be expected.

5. Enhances Financial Flexibility

When you are money handling regarding expenses, you can provide the freedom to

make choices about how you spend your time and money. This brings financial flexibility to your

life and reduces worries of any kind.

6. Increase Self-Awareness

When you track the expenses using a money management app like Spendable, you can

reveal areas for personal growth. For instance, you will be able to identify unnecessary spending

habits.

7. Promotes Personal Growth

As you manage the expenses, it demands discipline, responsibility and self-control. This leads to

personal growth and development.

8. Enhances Overall Life Satisfaction

When you keep the finances in control, it can contribute to a greater sense of overall life

satisfaction and ensure happiness.

Tips for Reducing Financial Stress and Achieving Balance

Financial stress is real. It can impact a person's well-being and affect them in several ways. This

is when you can follow a few tips for reducing financial stress and achieving balance in life. Some

of these tips are given below.

Tip 1: Track Expenses

The first thing you must do is monitor where your money is going. This will help to identify areas

for reduction and optimization. For this, you can use one of the best expense-tracking

apps Spendable. When you track the expenses, you get a chance to spend mindfully, make

financial control and increase financial savings.

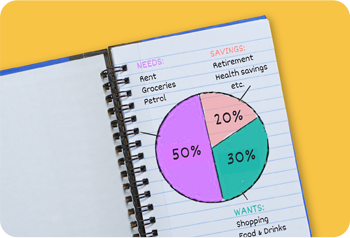

Tip 2: Create a Budget

The next thing you must do is create a budget. When a realistic budget plan is created, it

benefits in multiple ways. From allocating income towards necessities to savings and debt

repayments - everything is handled efficiently. When a budget is created, it also gives a deeper

insight into your financial situation.

Tip 3: Prioritize Needs Over Wants

Another way you can reduce financial stress is by distinguishing between essential expenses and

discretionary spending. You must prioritize needs over wants to ensure necessities are met first.

When needs are prioritized over wants, it helps you to save money and be clear about your expenses

at the same time.

Tip 4: Pay-Off High-Interest Debts and Build Emergency Funds

You must focus on eliminating high-interest debt to free up resources and reduce financial burden.

Make sure to save your expenses for 3-6 months for unexpected events. This will ensure financial

stability and help you to have peace of mind in times when you need emergency funds.

Tip 5: Automate Savings

You must set up automatic transfers to build wealth over time and for better monthly

handling. This makes it easier to save money and it is less prone to being neglected.

Tip 6: Avoid Impulsive Purchases and Develop Resilient Attitude

When you practice delayed gratification to reduce unnecessary spending, it makes it more

intentional for purchasing decisions. You must foster a growth mindset to view financial

challenges as an opportunity for growth and learning. As a result of this, encouragement can be

promoted. You can even consult with someone for personalized guidance and expertise when facing

complex financial situations.

Tip 7: Use Budget Apps

Another way you can reduce financial stress, achieve balance and improve your overall financial

well-being is by relying on a full-featured expense-keeping app like Spendable.

Such applications are designed to reduce financial stress and achieve balance as well.

Conclusion

By following the tips mentioned above, you will be reducing financial stress and achieving balance.

However, things are not as easy to maintain as it sounds. So, it is better to rely on a Pro

spending-tracking app like Spendable. Ever since the launch, more than 15,000 people have

downloaded it. Our application is an engaging and efficient solution that ensures stress-free money

management.

From adding expenses to setting a budget, creating split events to shopping lists and family budgets

- everything can be done. Not only that, it comes with AI-driven voice tracking for enhanced

convenience. As you use this personal budget app, it allows you to effortlessly

track income, prevent overspending and gain insight into all transactions.

FREE

Available on

FREE

Available on